Before Bankruptcy, There Are Two Ways Your Credit Score Tricks You

Are you worried about what bankruptcy will do to your credit score?

Your credit score is the tool the banks and credit card companies use to trick you into paying them, even when you can’t afford it. Think for a moment. Is your credit score more important than feeding your children? Probably not.

Back in 1934, the Supreme Court said that a fresh start in bankruptcy is “of public, as well as private, interest.” Here’s what they meant. The country is better off if you take care of your family; Capital One will be ok without your help. The fear of your after-bankruptcy credit score tricks people into worrying about the wrong thing.

There’s a second reason it really is a trick. When you file for bankruptcy, your credit score will go up. (At least for most people.)

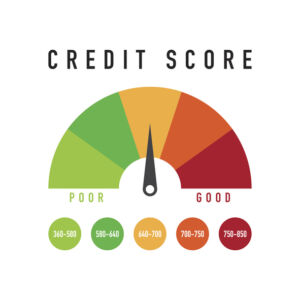

We talk to people whose score is around 550 and assume with bankruptcy it will drop into the 400s. The opposite will actually happen. For most people, their credit score after bankruptcy will shoot up over 600.

Not only that. Within six months, Capital One will be offering you a new credit card.